The Value of Due Diligence & Accelerated Integration

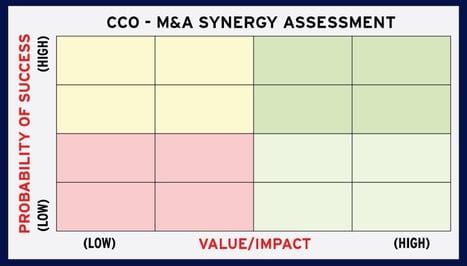

The Cornerstone Way is rooted in accountability, discipline, and execution. We have the depth and breadth of experience and the tools necessary to rapidly deploy strike teams and quickly assess M&A target companies in terms of performance, alignment, and probability of long-term success. An integral part of our standard due diligence report is an assessment of expected synergies, including the complexity or investment involved in achieving them, their probability of success, and the value they would deliver. This is fundamental to the overall valuation of a transaction. We have delivered significant business value in many segments, including aftermarket distribution, high-touch retail, class 8 truck, consumer goods, government and defense, food/FDA, Tier 1 and 2, and automotive OEM.

Investment Thesis

Investment Thesis

Our approach to M&A and investment analysis is very simple. We first work with our clients to develop an investment thesis for the subject opportunity. This includes a description of the opportunity and its background, assets, value drivers, and commercial considerations as well as assessments of risk and the potential economics of the investment. The investment thesis provides the baseline for strategic and financial alignment of the opportunity.

Viability Assessment

Next, we assess the viability of the target in four major categories:

Operations

- Efficiency

- Standardization

- Quality

- Scalability

Commercial

- Potential for growth

- Competitive environment

- History of customer satisfaction

Financial

- Profitability

- Creditworthiness

- Availability of capital

Workforce

- Stability

- Capability

- Engagement

- Agility

We build our strike team around these core competencies and ensure their expertise is founded in the appropriate sector. The team is armed with robust and efficient assessment tools to rapidly deliver the decision-making intelligence necessary to execute the transaction.

Success Stories

Partnering in our client’s success is at the core of the Cornerstone Way. Cornerstone has been fortunate to partner with private equity firms across multiple funds and industries. Our content and delivery model have provided direct operational support to rationalize and optimize many asset portfolios. See some of our more diverse and notable private equity-related engagements described below.

- Cornerstone deployed a strike team and interim leadership to turn around and optimize a multi-plant operation in the HD Truck market. This included restoring integrity to production, quality, and delivery operations.

- We facilitated a full operational excellence deployment to improve material flow and logistics in the construction and building material industry. The results included a compressed operating pattern (reduced by 1 full shift) and increased capacity, allowing for more sales volume.

- We deployed a strike team in a Tier 1 and 2 automotive supplier to optimize production, warehousing, and distribution operations.

- Cornerstone positioned an international advisory team with a pharmaceutical client to reduce production-to-warehouse time in transit from 63 days down to 6 days, which included a border crossing, FDA approval, and sterilization. We also eliminated quality defects and implemented standardized work.

- Our strike team inserted into a Tier 1 automotive conglomerate to assume full operational responsibility for a production facility. The rapid deployment of the Cornerstone Way completely transformed the facility. Throughput velocity and output improved and stabilized, and overall equipment effectiveness increased 26%. We re-established on-time delivery, eliminated premium freight, and restored overall profitability.

- Cornerstone place a program launch team with another private equity-backed automotive supplier with assets in the US and Mexico. Implementing our operational excellence model, the Cornerstone Way, the team restored launch schedule integrity and significantly improved quality, cost, and delivery performance across multiple facilities. Based on success of this engagement, interim leaders were placed in permanent key positions.

The Cornerstone Difference

Cornerstone Consulting is proud to be a certified Veteran-Owned Small Business. We deliver excellence with intensity, humility, and a fierce resolve to drive results and accelerate value. We have the talent and the bandwidth necessary to improve cash flow, EBITDA, and return on investment. This may begin at target screening, ramp-up, during integration, or throughout the divestiture process. Our approach has been validated across businesses, industries, and regions. At Cornerstone, we believe M&A excellence is not about incremental benefit; it’s about building and sustaining a decisive competitive advantage.

Are you trying to grow your asset portfolio but struggling to identify and validate targets? Are your due diligence reports lacking in substance? Are post-transaction synergies failing to materialize? Consider partnering with Cornerstone Consulting to accelerate your time-to-value with M&A pursuits and post-transaction asset optimization. For more information, visit us here or contact us directly at 1-888-324-4808.

Comments