In 2026, labor volatility has become a permanent operational condition rather than a temporary disruption. Across manufacturing, logistics, automotive, food and beverage, aerospace, and healthcare systems, leaders are confronting the same reality: demand fluctuates faster than hiring cycles, skills are harder to secure, and traditional workforce models are no longer sufficient to protect operational performance.

According to the U.S. Bureau of Labor Statistics, job openings in manufacturing, transportation, and warehousing have consistently exceeded pre-2020 levels, while quit rates remain elevated. At the same time, Deloitte’s 2024 Manufacturing Outlook reports that 83% of manufacturing executives rank workforce availability among the top three threats to meeting production targets. These pressures are compounded by rising overtime costs, burnout among core teams, and increasing service-level penalties tied to missed deliveries.

As a result, companies are shifting away from purely headcount-based workforce planning and toward workforce capacity expansion models, flexible, execution-driven approaches that allow organizations to scale labor capacity rapidly without compromising control, quality, or cost discipline.

This shift is not an HR trend or a staffing tactic. It is an operational resilience strategy used by leading operations firms to protect throughput, stabilize supply chains, and enable faster response to market volatility.

What Is Workforce Capacity Expansion in Modern Operations?

Workforce capacity expansion is the strategic ability to increase or decrease labor capacity quickly in response to operational demand, using flexible staffing models rather than relying solely on permanent, full-time hiring.

Unlike traditional staffing approaches that focus on filling roles, workforce capacity expansion focuses on maintaining flow. The objective is to ensure that production lines, warehouses, service operations, and supply chains continue to perform even when demand spikes, disruptions occur, or internal labor availability falls short.

Workforce capacity expansion typically includes:

- Contingent staffing for short- to medium-term volume increases

- Emergency staffing solutions to stabilize operations during labor shocks or disruptions

- Skilled trades & technical experts deployed to constraint or specialty roles

- Supply chain gap support to prevent bottlenecks across production, warehousing, and fulfillment

In practice, this means labor becomes a scalable input aligned to demand signals, not a fixed cost that lags reality. Many business operations firms now view workforce flexibility as a core operational capability rather than a reactive solution.

Why Traditional Hiring Models Are Failing Under Labor Volatility

Permanent hiring remains essential for core roles, leadership continuity, and institutional knowledge. However, it is increasingly misaligned with the pace and volatility of modern operations.

The average time-to-hire for skilled manufacturing and technical roles now exceeds 60 days, according to SHRM, while many operational disruptions require action within days, or even hours. At the same time, demand patterns are becoming less predictable due to e-commerce volatility, supply chain reconfiguration, reshoring efforts, and customer expectations for faster delivery.

This mismatch creates three structural problems:

- Lag risk: Hiring cannot keep pace with demand surges.

- Cost inflation: Overtime and burnout rise as internal teams absorb volatility.

- Rigidity: Headcount remains fixed even when demand normalizes.

Workforce capacity expansion addresses these issues by decoupling operational capacity from permanent headcount growth—an approach increasingly supported by modern operations services.

When to Use Contingent Staffing vs Full-Time Hiring

High-performing organizations in 2026 do not treat workforce planning as a binary choice. They design hybrid labor models that intentionally balance full-time employees with contingent staffing.

According to McKinsey, organizations using flexible workforce models can respond to demand changes 20–30% faster than those relying primarily on permanent hiring. Additionally, Gartner research shows that companies integrating contingent staffing into workforce strategy reduce overtime costs by up to 25%, while improving employee retention among core teams.

In this context, contingent staffing is not a cost shortcut, it is a risk mitigation mechanism that allows operations firms to protect execution without overextending internal resources.

Industries Seeing the Fastest Surge in Workforce Capacity Expansion

Logistics and Warehousing: Scaling Through Warehouse Staffing Agency Partnerships

Logistics remains one of the most labor-constrained and demand-volatile sectors. The continued growth of e-commerce, regional fulfillment strategies, and omnichannel distribution has intensified pressure on warehouse operations.

According to CBRE, U.S. warehouse absorption remains historically high, while labor availability has not kept pace. As a result, many operators rely on warehouse staffing agency partnerships and flexible labor pools to protect pick rates, dock throughput, and on-time delivery during peak demand.

Automotive Manufacturing and Supplier Networks: Managing Volatility with Automotive Staffing

Automotive production has become increasingly program-driven, with frequent volume changes tied to model launches, supplier transitions, and electrification initiatives. Automotive staffing now requires rapid access to skilled trades, maintenance technicians, launch support teams, and quality specialists.

A PwC automotive industry survey found that over 70% of automotive suppliers expect workforce flexibility to be critical for meeting future production schedules, particularly during new program ramp-ups.

Food and Beverage Operations: Stabilizing Through Emergency Staffing Solutions

Food and beverage manufacturers face some of the highest labor volatility due to turnover, seasonal demand, and strict production timelines. Even short disruptions can result in waste, missed shipments, or customer penalties.

According to IBISWorld, labor shortages have increased operating costs in the F&B sector by more than 15%, pushing many companies to adopt emergency staffing solutions rather than expanding permanent headcount.

Aerospace and Advanced Manufacturing: Workforce Capacity Expansion for Program-Based Demand

Aerospace and defense operations depend heavily on skilled trades & technical experts, many of whom are aging out of the workforce. Program-based demand and strict compliance requirements make permanent hiring both slow and risky.

The Aerospace Industries Association reports that nearly 40% of aerospace manufacturers struggle to meet labor requirements tied to contract timelines, accelerating the adoption of project-based workforce expansion models supported by specialized operations services.

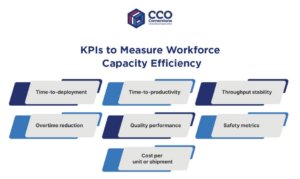

KPIs to Measure Workforce Capacity Efficiency and Execution Control

Scaling labor without performance visibility often creates more problems than it solves. Execution-focused organizations measure workforce capacity expansion using operational metrics rather than headcount.

Critical KPIs include:

- Time-to-deployment: speed from labor request to on-site availability

- Time-to-productivity: how quickly workers reach expected output

- Throughput stability: units/hour, orders/day, or line-rate consistency

- Overtime reduction: whether flexible labor reduces internal strain

- Quality performance: defect rates, rework, audit findings

- Safety metrics: incident rates and compliance adherence

- Cost per unit or shipment: true cost relative to output

According to Deloitte, organizations that actively manage these KPIs alongside staffing decisions achieve up to 18% higher operational efficiency than those that scale labor reactively.

The Workforce Capacity Expansion Operating Model for Scalable Execution

The most common failure in workforce expansion is treating it as a staffing transaction rather than an operating system. High-performing business operations firms build a repeatable operating model that links demand signals directly to labor deployment and performance control.

A strong workforce capacity expansion model includes:

- Clear demand triggers tied to backlog, service-level risk, or production schedules

- Role segmentation, identifying which roles are core, flex, or surge

- Standardized onboarding and training to compress ramp-up time

- Constraint-focused deployment to protect flow

- Daily floor-level performance visibility and accountability

Where Workforce Capacity Expansion Breaks Down Without Process Discipline

Scaling labor without fixing execution often amplifies existing problems. Adding people to a broken process increases complexity, error rates, and supervisory strain.

Common failure points include:

- Lack of standardized work or SOPs

- Scaling non-constraint roles

- Weak floor supervision

- Slow time-to-productivity

- Quality degradation under pressure

- Poor governance of staffing partners

According to Harvard Business Review, organizations that scale labor without process discipline experience error rate increases of up to 30%, eroding the benefits of added capacity.

Case Study: Workforce Capacity Expansion in Practice

A multi-site distribution operation supporting national retail clients consistently missed shipping windows during peak demand. Full-time hiring lagged demand, while overtime costs and employee turnover increased.

By implementing a workforce capacity expansion model—combining contingent staffing, warehouse staffing agency partnerships, standardized onboarding, and tighter floor control, the organization:

- Reduced late shipments by over 30%

- Lowered overtime dependency

- Improved workforce stability during peak cycles

The critical shift was treating labor as a throughput lever, not a static cost.

Why Workforce Capacity Expansion Matters for CCO and Its Clients

For CCO, workforce capacity expansion is not about staffing volume, it is about execution under pressure. Scaling labor without protecting flow, quality, and control only creates noise.

CCO helps organizations:

- Align workforce strategy with operational constraints

- Design repeatable workforce capacity expansion models

- Stabilize throughput during volatility

- Convert labor flexibility into measurable results

If labor volatility, backlog, or missed delivery targets are impacting your operation, CCO —an execution-focused business operations firm— helps design workforce capacity expansion models that protect execution, without bloated headcount or slow hiring cycles.

FAQs on Workforce Capacity Expansion and Contingent Staffing Models

What is workforce capacity expansion and how does it work?

Workforce capacity expansion allows companies to scale labor quickly using contingent staffing, emergency staffing solutions, and skilled trades support aligned to operational demand rather than fixed headcount.

How fast can companies scale labor using contingent staffing?

Many organizations can deploy labor within days, especially in logistics and manufacturing environments, assuming pre-vetted talent pools and standardized onboarding.

Which industries rely most on surge staffing?

Logistics, automotive, food and beverage, aerospace, healthcare operations, and high-volume manufacturing rely heavily on workforce capacity expansion due to volatile demand and labor constraints.